Understanding the basics

-

Withdraw all of your Defined Contribution (DC) pension pot as cash lump sums

You can take your DC pension pot as one or two cash lump sums (split between two tax years). If you decide to take your DC pension pot as two separate cash payments, the first cash payment will be paid at your selected retirement date and the balance will be paid shortly after the start of the tax year following your selected retirement date, usually at the end of April. If you would like to take your DC pension pot as more than two lump sums, you will need to transfer your benefits out of the Scheme. -

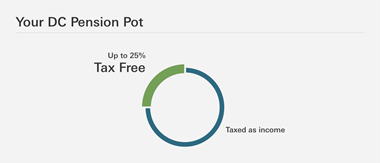

Take up to 25% of each lump sum tax-free

Normally 25% of each lump sum can be paid tax-free (up to the Lifetime Allowance), but the remaining 75% will be subject to income tax. Watch out because this could push you into a higher tax bracket as your income is not spread out. -

Remaining cash from your lump sum will be included in your estate

No specific pension provision will be made for your partner or dependants after you die. However, any remaining cash from your lump sum would normally be included in your estate.